How to Hire the Right CFO for Your HVAC Roll-Up: A Strategic Guide for Residential Services

How to Hire the Right CFO for Your HVAC Roll-Up: A Strategic Guide for Residential Services

In a crowded residential HVAC market, PE-backed companies gain an edge with a CFO who’s a value-creation partner—shaping capital allocation, pricing, and M&A to lift multiples. The role demands mastery of HVAC realities: seasonal cash-flow swings (40% cite cash flow as a top pain), heavy fleet/equipment capex, multi-stream revenues, technician-productivity metrics, and investor-grade KPIs. Top hires blend GAAP/ERP, debt and integration chops with field-service know-how (service-contract revenue recognition, utilization-based comp) and multi-site leadership, then notch quick wins in working capital, pricing, branch profitability, reporting, and forecasting. Skip “pure accountant” profiles and run a disciplined, case-based search with a clear 12–24-month mandate—the right HVAC CFO becomes the analytical engine behind scalable growth and PE-grade results.

Why hire a CFO for a PE-backed HVAC company

Understanding the Unique Needs of HVAC Service Companies

Seasonal Revenue Fluctuations

High Capital Expenditure Needs

Complex Service Pricing Models

Multiple Revenue Streams

Technician Productivity Metrics

Industry-specific KPIs

The Evolution of the CFO Role in HVAC Companies

Key Qualifications to Look for in a Home Services CFO

Technical Finance Skills

Industry-Specific Knowledge

Strategic Leadership Abilities

The Hiring Process: Best Practices

1. Precise Position Scoping

2. Targeted Recruiting Strategy

3. Comprehensive Assessment Process

4. Strategic Industry References

First 90 Days: Setting Your CFO Up for Success

1. Comprehensive Onboarding

2. Quick Wins Identification

3. Strategic Initiative Alignment

Common Pitfalls to Avoid When Hiring Your HVAC CFO

Conclusion

Why hire a CFO for a PE-backed HVAC company

It’s no secret that the residential HVAC services sector is incredibly competitive today. With more investors than ever in the space, bringing on a specialized CFO can be an important piece in gaining a competitive advantage in the market. As Private Equity investors navigate complex portfolio optimization strategies, many require financial leadership that transcends traditional CFO functions. Beyond mere custodianship of financial resources, a strategically-oriented CFO serves as a critical value creation catalyst: architecting operational efficiency frameworks, engineering strategic acquisition pathways, and taking capital allocation decisions to enhance enterprise valuation multiples.

Finding a CFO specifically calibrated to the unique economic dynamics of mid-market HVAC portfolio assets, however, is no easy task. In the following guide, we will discuss the unique challenges in HVAC service companies and how to find a CFO up to the job. We will discuss the ideal profile and background, how to identify CFOs in the market, and provide guidance on running a disciplined search in order to recruit a top CFO for your HVAC company.

Have a role you'd like to discuss?

Looking to expand your team?

Understanding the Unique Needs of HVAC Service Companies

To find the best CFO for your company, start by brainstorming the specific financial challenges and opportunities you’re looking to solve. For HVAC service businesses, you can start with the following:

Seasonal Revenue Fluctuations

HVAC companies face significant revenue swings throughout the year, with 40% citing cash flow management as their top challenge. These seasonal patterns create predictable but challenging financial conditions that require strategies like maintenance contracts to stabilize cash flow during slower periods.

High Capital Expenditure Needs

HVAC businesses require substantial investment in service vehicles and specialized equipment that represent significant balance sheet assets. These capital expenditures add long-term value to the company but depreciate over time, requiring careful financial planning and management.

Complex Service Pricing Models

Effective pricing strategies must balance market competitiveness with adequate profit margins. The ideal approach “strikes the perfect balance between attracting customers with reasonable rates and maximizing revenue streams” while covering operational costs.

Multiple Revenue Streams

Successful HVAC companies diversify income through installation, maintenance contracts, emergency repairs, and equipment sales. Service agreements particularly help with cash flow during shoulder seasons when demand traditionally drops.

Technician Productivity Metrics

Field technician efficiency directly impacts financial performance through labor utilization rates and service completion times. With labor costs representing the biggest single expenditure in most HVAC businesses optimizing productivity metrics is essential for profitability.

Industry-specific KPIs

Beyond standard financials, HVAC companies need specialized metrics to accurately assess business health. Advanced field service management software enables tracking of critical KPIs like call booking rates and conversion metrics that drive informed operational decisions.

Of course, each of these components will be adjusted depending on the specific needs and goals of the business. For PE-backed HVAC companies, for example, more emphasis should be placed on CFOs who have prior experience with rigorous reporting requirements and KPIs required by the investors.

The Evolution of the CFO Role in HVAC Companies

In recent years, we’ve seen the CFO role in residential services companies evolve from pure accounting oversight to strategic partnership. According to McKinsey research, today’s CFOs are increasingly expected to be active participants in shaping company strategy, not just managing finances. For HVAC companies specifically, CFOs must bridge financial expertise with operational insights to drive enterprise value.

As noted by Deloitte, modern CFOs must play four diverse roles: steward (preserving assets), operator (running efficient finance operations), strategist (influencing company direction), and catalyst (driving change throughout the organization). Finding a CFO that has this wide spectrum of experiences under their belt is no meager task, which is why many PE-backed HVAC companies turn to a top CFO search firm.

Let’s take a closer look at the key qualifications you should consider in your search for your CFO.

Key Qualifications to Look for in a Home Services CFO

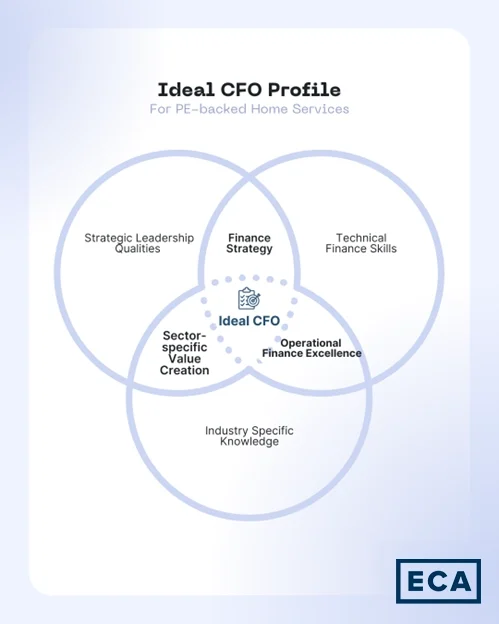

Take a look at the Venn-diagram above. As you can see, the ideal CFO for an HVAC company has a combination of technical finance skills, industry-specific knowledge, and strategic leadership abilities.

This is a great framework for thinking through the target profile. A CFO with tremendous technical finance skills and industry knowledge will excel operationally but will struggle to act as a strategic thought partner to the CEO and Board. On the other hand, a CFO with strong strategic leadership qualities and technical finance skills will excel at shaping finance strategy, but may struggle to develop a specific value-creation plan for the HVAC industry. Ideally, find a candidate with a healthy balance of all three.

Let’s take a closer look at all three skillsets:

Technical Finance Skills

- Strong GAAP accounting foundation

- Experience with service-industry metrics and KPIs

- Cash flow forecasting expertise in seasonal businesses

- Proficiency with ERP systems common in field service operations

- M&A financial modeling and integration experience

- Bank relationship and debt covenant management

Industry benchmarks from ServiceTitan and FieldInsight indicate that financial leaders in high-performing HVAC companies must excel at tracking metrics beyond basic revenue, including customer acquisition costs, service call completion rates, and technician utilization.

Industry-Specific Knowledge

Industry-specific knowledge equips CFOs with critical insight into the unique operational and revenue dynamics of residential HVAC businesses, enabling them to implement financial strategies that accurately reflect service-based business realities. Without this specialized expertise, even the most technically proficient financial leaders may miss crucial opportunities to optimize cash flow, properly structure service contracts, and develop compensation models that truly drive technician productivity and overall business performance.

That’s why we recommend finding a CFO who has the following industry knowledge:

- Understanding of residential services business models

- Familiarity with field service operations and their financial impacts

- Knowledge of service contract revenue recognition

- Experience with technician productivity metrics and compensation models

- Comprehension of HVAC equipment financing and leasing structures

Strategic Leadership Abilities

Strategic leadership abilities transform CFOs from financial stewards into value creation catalysts. These competencies enable them to spot performance patterns across multiple locations, drive data-informed decisions, and successfully integrate acquisitions. Such leadership skills are essential for maximizing enterprise value within tight private equity investment timelines.

- Pattern recognition across multiple locations/branches

- Data-driven approach to operational decision-making

- Roll-up acquisition integration experience

- Private equity reporting and communication skills

- Change management capabilities in family-owned business transitions

- Experience scaling financial functions during rapid growth

The Hiring Process: Best Practices

1. Precise Position Scoping

- Clearly define the strategic priorities for the first 12-24 months

- Articulate the CFO’s role in your value creation plan

- Specify reporting relationships and expected interactions with the board

- Detail the current state of the financial function and required improvements

2. Targeted Recruiting Strategy

- Consider candidates from adjacent field service industries (plumbing, electrical, pest control)

- Look for professionals with PE portfolio company experience

- Leverage industry-specific executive recruiters with HVAC sector knowledge

- Evaluate candidates from larger HVAC companies who seek more strategic influence

- Consider divisional finance leaders from major service companies ready for a CFO role

3. Comprehensive Assessment Process

- Case studies simulating actual HVAC financial challenges

- Board presentation exercises demonstrating communication skills

- Operational leader interviews to evaluate cross-functional collaboration

- References from private equity investors, not just past employers

- Assessment of cultural fit with founder-led or family business environments

4. Strategic Industry References

- Stay current with best practices through the ACCA (Air Conditioning Contractors of America) professional network

- Utilize benchmarking data from Service Nation Alliance for industry-specific metrics

- Consult resources from the Financial Executives International (FEI) for CFO development

- Reference HVAC industry reports for market trend insights

- Monitor relevant trends through the CFO Leadership Council

First 90 Days: Setting Your CFO Up for Success

1. Comprehensive Onboarding

- Scheduled meetings with all key operational leaders

- Branch location visits to understand field operations

- Deep-dive review of historical financial performance

- Introductions to banking relationships and external auditors

- Clear articulation of Board reporting expectations

Effective CFOs must quickly understand existing financial operations and implement process improvements that create efficiencies while providing deeper financial insights to executives and ownership. Setting up an effective onboarding process shortens the runway needed for your CFO to understand the objectives and challenges specific to your home services company.

2. Quick Wins Identification

Next, touch base with your new CFO on their plans for quick wins to ensure alignment. Here are a few of the most common quick wins we hear from our private equity clients investing in HVAC companies:

- Working capital improvement opportunities

- Service pricing optimization analysis

- Branch profitability comparison framework

- Financial reporting enhancements for operational decision-making

- Cash flow forecasting system implementation

3. Strategic Initiative Alignment

Thinking long-term, make sure you, the other investors, and the SLT is aligned on the CFO’s strategic goals. While each of these will be company specific, here is a short list off common strategic goals we discuss with our clients:

- Integration into ongoing operational excellence programs

- Involvement in technician productivity improvement efforts

- Participation in acquisition target assessment

- Leadership in technology implementation decisions

- Partnership with sales in service contract structure development

Common Pitfalls to Avoid When Hiring Your HVAC CFO

Finally, makes sure you avoid these common mistakes we see when companies make poor hiring decisions:

- Hiring pure accountants without strategic capabilities

- Undervaluing industry-specific knowledge in favor of general finance skills

- Failing to assess cultural fit with service-oriented organizations

- Neglecting the importance of operational partnerships

- Setting unrealistic expectations for immediate financial transformations

- Insufficient focus on systems and processes for multi-location businesses

Conclusion

The right CFO for your HVAC company is more than a financial expert—they are a strategic partner who can translate operational metrics into enterprise value creation. By taking a deliberate approach to defining requirements, recruiting strategically, and setting clear expectations, companies can identify and hire transformational financial leaders who will significantly enhance their residential service investments.

According to industry experts, financial leadership in HVAC businesses is particularly crucial due to the seasonal nature of the business and complex revenue streams. With proper financial leadership in place, HVAC companies can better navigate these challenges while positioning themselves for sustainable growth.

For HVAC service companies looking to maximize value, the CFO hire may be the single most important executive decision in their growth journey. When properly selected and empowered, these financial leaders become the analytical engine driving strategic growth, operational efficiency, and ultimately, successful business outcomes.

Steven Haug is a Managing Director at ECA Partners. He can be reached at [email protected].

Tony Topoleski is a Senior Director at ECA Partners. He can be reached at [email protected].